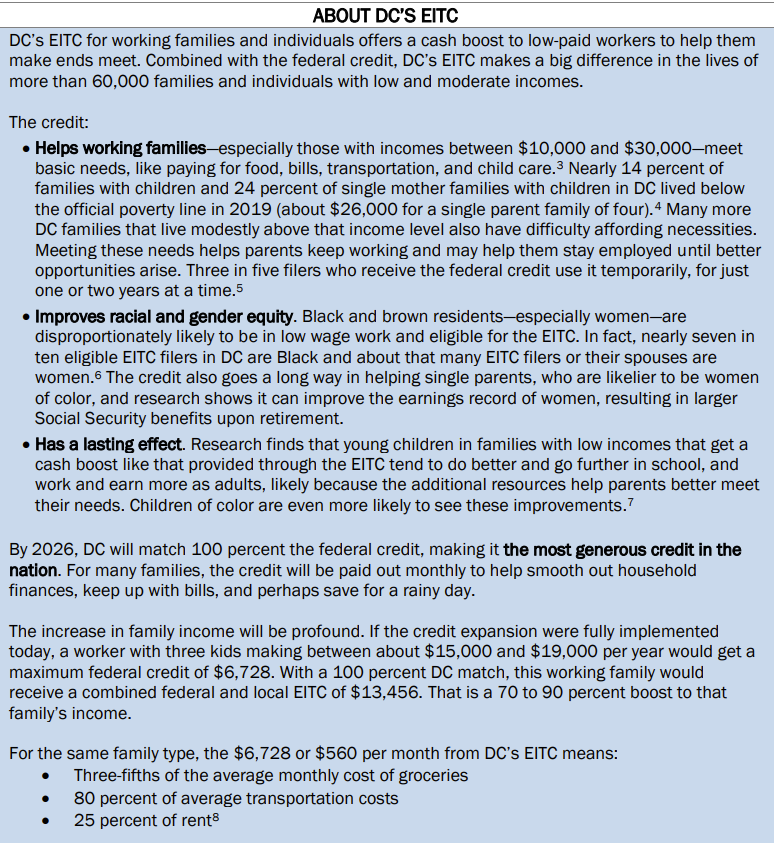

maryland local earned income tax credit

After Fridays vote Marylanders without children who earn no more than 15820 a year including undocumented residents can collect the. On average beneficiaries in Maryland increase their earnings enough after three years that they no longer qualify for the credit according to a legislative review of its impact.

If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to 50 of the federal tax credit.

. 28 of federal EITC. In May 2018 Maryland passed legislation to eliminate the minimum age requirement for the state-level EITC. Earned Income Tax Credit EITC Rates.

The Maryland earned income tax credit EITC will either reduce or. The local income tax is calculated as a percentage of your taxable income. 2021 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers who have income and have worked.

To be eligible for the federal and Maryland EITC your federal adjusted gross income and your earned income must be less than the following. An expansion of Marylands Earned Income Tax Credit passed quietly into law when Gov. R allowed the bill to take effect without his signature.

Senate Bill 218 extends the tax credit to people who pay taxes using Individual Taxpayer Identification Numbers ITINs for the 2020 2021 and 2022 tax years. Marylands 23 counties and Baltimore City levy a local income tax which we collect on the state income tax return as a convenience for local governments. The amount of the credit allowed against the local income tax is equal to the federal credit claimed multiplied by 10 times the county income tax rate not to exceed the income tax liability.

HB 680 does not alter the credit amount for filers claiming depending children. The Earned Income Tax Credit also known as EITC or EIC is a benefit designed to support low- to moderate-income working people. 1nter your taxable net income from Form 502 or Form 502X.

CALENDAR TAX YEAR 201 OR FISCAL YEAR BEGINNING 201 ENDING 201. Some taxpayers may even qualify for a refundable Maryland EITC. 2021 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers who have income and have worked.

Marylanders who made 57000 or less in 2020 may qualify for both the federal and state Earned Income Tax Credits as well as free tax preparation by the CASH Campaign of Maryland. Or Form 504 E. 33 rows States and Local Governments with Earned Income Tax Credit.

Average tax credits per tax return for these ZIP Codes range from a high of 3060 in Park Hall 20667 in Saint Marys County to a low of 2668 received in Southwest Baltimore 21216. The Earned Income Tax Credit EITC is a benefit for working people with low to moderate income. The Comptroller of Maryland will allow a Maryland income tax credit for the amount certified by the Department of Natural Resources not to exceed the lesser of 1500 per taxpayer or the amount of the State income tax liability.

MARYLAND FORM 502LC STATE AND LOCAL TAX CREDIT FOR INCOME TAXES PAID TO OTHER STATES AND LOCALITIES Attach to your tax return. Ii Primary Staff for This Report. Local officials set the rates which range between 225 and 320 for the current tax year.

The allowable Maryland credit is up to one-half of the federal credit. If you are a part-year resident or a member of the military see Instruction 26o before completing this worksheet. BALTIMORE MD The Maryland Department of Human Services is strongly encouraging eligible Marylanders to take advantage of the Earned Income Tax Credit Benefit.

50954 56844. A taxpayer can also claim a nonrefundable earned income credit against the local income tax. Some taxpayers may even qualify for a refundable Maryland EITC.

50 of federal EITC 1. March 9 2021. The average amount of EITC in 2013 for all of Maryland was 2257.

See Worksheet 18A1 to calculate any refundable earned income tax credit. The state EITC reduces the amount of Maryland tax you owe. You should report your local income tax amount on line 28 of.

See Marylands EITC information page. If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to 50 of the federal tax credit. Although no county has established a refundable earned income credit that can be claimed.

If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to 50 of the federal tax credit. HB 680 increases the value of Marylands Earned Income Tax Credit for workers who dont have children and non-custodial parents who arent claiming dependents on their taxes by increasing the state credit to a 100 match of the federal credit for eligible filers. Required to file a tax return.

A taxpayer can also claim a nonrefundable earned income credit against the local income tax. If the credit is more than the state tax liability the unused credit may not be carried forward to any other tax year. Most taxpayers who are eligible and file for a federal EITC can receive the Maryland state and local EITC.

The amount of the credit allowed against the local income tax is equal to the federal credit claimed multiplied by 10 times the county income tax rate not to exceed the income tax liability. The Earned Income Tax Credit also known as Earned Income Credit EIC is a benefit for working people with low to moderate income. Although no county has established a refundable earned income.

Thelocal EITC reduces the amount of county tax you owe. Thelocal EITC reduces the amount of county tax you owe. Most taxpayers who are eligible and file for a federal EITC can.

Taxpayers without a qualifying child may claim 100 of the federal earned income credit or 530 whichever is less. The state EITC reduces the amount of Maryland tax you owe.

Dc S Earned Income Tax Credit The Most Generous In The Nation But Not The Most Inclusive

Legislative Momentum In 2022 New And Expanded Child Tax Credits And Eitcs Itep

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

Summary Of Eitc Letters Notices H R Block

How To Receive The Child Tax Credit And Or Earned Income Tax Credit The United Food Commercial Workers International Union The United Food Commercial Workers International Union

What Are Marriage Penalties And Bonuses Tax Policy Center

How Do State Earned Income Tax Credits Work Tax Policy Center

Earned Income Tax Credit Eitc What Is It Who Qualifies Nerdwallet

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

/FederalincometaxGettyImages-64622606222-42f130f0f35546168fe4f00f932a2ebd.png)

Changes To Eitcs For The 2022 Filing Season

Earned Income Tax Credit Now Available To Seniors Without Dependents

Earned Income Tax Credit Eitc Interactive And Resources

Irs Notice Cp79 We Denied One Or More Credits Claimed On Your Tax Return H R Block

Do You Need To File A Tax Return In 2018

Earned Income Credit H R Block

How Older Adults Can Benefit From The Earned Income Tax Credit

Dc S Earned Income Tax Credit The Most Generous In The Nation But Not The Most Inclusive