kentucky sales tax on-farm vehicles

Section 138470 - Exemptions from tax. Multiply the vehicle price before trade-ins but after.

Kentucky Sales Tax Small Business Guide Truic

For example an item that costs 100 will have a tax of 6 for a total of 106 100 times 06 equals.

. To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county. There is expressly exempted from the tax imposed by KRS 138460. Effective January 1 2023 limousine service providers are subject to a 6 excise tax on the gross receipts of vehicle rentals peer-to-peer car sharing rentals ride share.

16 2022 To help Kentuckians combat rising prices due to inflation brought on by the global pandemic Gov. For example Kentucky exempts from tax feed farm. In addition to taxes car purchases in Kentucky may be subject to other fees like registration title and plate fees.

Relative Content The Kentucky Transportation Cabinet is responsible for all title and watercraft related. 1 a Motor vehicles titled or registered to the United States or to the. State Tax Rates.

Kentucky collects a 6 state sales tax rate on the purchase of all vehicles. To calculate Kentuckys sales and use tax multiply the purchase price by 6 percent 006. Kentucky sales tax law includes numerous general agricultural exemptions but many do not apply to the equine industry.

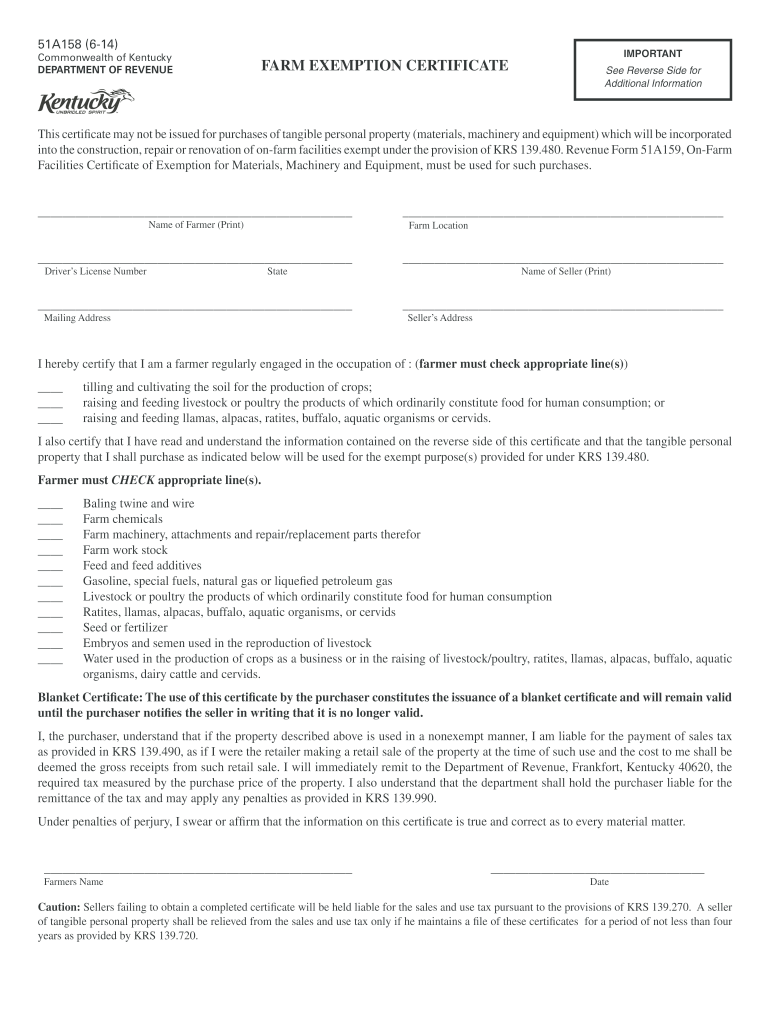

For Kentucky it will always be at 6. Printable Kentucky Farm Certificate of Exemption Form 51A158 for making sales tax free purchases in Kentucky. Andy Beshear announced today that he is.

It is levied at six percent and shall be paid on every motor vehicle used in Kentucky. It is levied at 6 percent and shall be paid on every motor vehicle used in Kentucky. Items that can be purchased sales tax free for legitimate farm use.

Kentucky S Car Tax How Fair Is It Whas11 Com

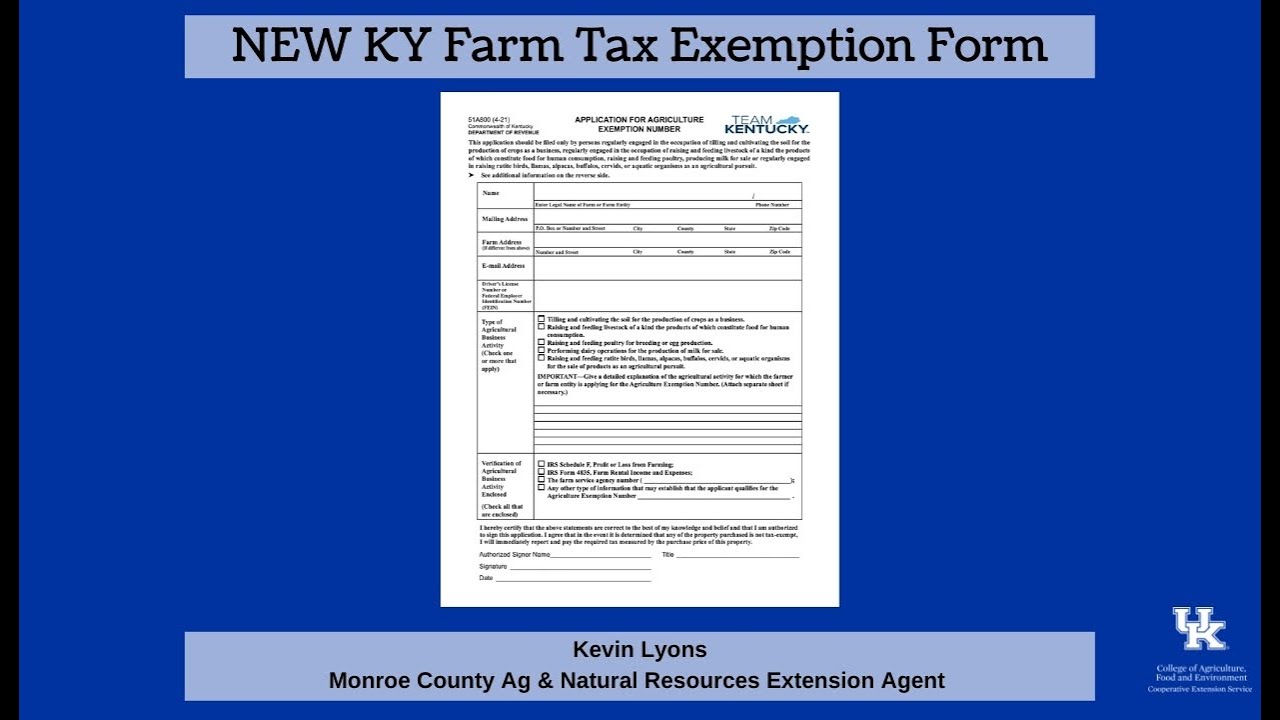

Update On Agriculture Exemption Number For Sales Tax Exemption On Farm Purchases Agricultural Economics

Ag Prepares For Electric Powered Future

Deadly Tornado Outbreak Tornado News Death Toll Rises As States Assess Damage The New York Times

Agriculture Exemption Number Now Required For Tax Exemption On Farm Purchases Agricultural Economics

Commercial Truck Size Weight Limits Temporarily Suspended Texas Farm Bureau

Farmers Must Apply For New Tax Exemption Number News Paducahsun Com

Ag Prepares For Electric Powered Future

Farm Exemption Kentucky Fill Online Printable Fillable Blank Pdffiller

The 2022 Pennsylvania Agriculture Power 100 City State Pennsylvania

Publication 225 2022 Farmer S Tax Guide Internal Revenue Service

Eastern Kentucky Farm Equipment For Sale Facebook

Form 51a158 Fillable Farm Exemption Certificate

New Ky Farm Tax Exemption Forms Youtube

Mack Trucks For Sale In Kentucky 25 Listings Truckpaper Com Page 1 Of 1

How This Farmer S Amazon Career Helps Him Feed His Community